WAEC: COMMERCE

Quizzes

-

2014 Commerce WAEC Objective Past Questions

-

2014 Commerce WAEC Theory Past Questions

-

2015 Commerce WAEC Theory Past Questions

-

2015 Commerce WAEC Objective Past Questions

-

2016 Commerce WAEC Objective Past Questions

-

2016 Commerce WAEC Theory Past Questions

-

2017 Commerce WAEC Objective Past Questions

-

2017 Commerce WAEC Theory Past Questions

-

2018 Commerce WAEC Objective Past Questions

-

2018 Commerce WAEC Theory Past Questions

-

2019 Commerce WAEC Objective Past Questions

-

2019 Commerce WAEC Theory Past Questions

-

2020 Commerce WAEC Objective Past Questions

-

2020 Commerce WAEC Theory Past Questions

-

2021 Commerce WAEC Objective Past Questions

-

2021 Commerce WAEC Theory Past Questions

Quiz Summary

0 of 8 Questions completed

Questions:

Information

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading…

You must sign in or sign up to start the quiz.

You must first complete the following:

Results

Results

0 of 8 Questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 point(s), (0)

Earned Point(s): 0 of 0, (0)

0 Essay(s) Pending (Possible Point(s): 0)

Categories

- Not categorized 0%

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- Current

- Review

- Answered

- Correct

- Incorrect

-

Question 1 of 8

1. Question

A sole proprietor has been advised to advertise her business in order to increase sales.

(a) (i) List four advertising media she could use.

(ii) State four factors she could consider in the choice of a medium.

(b) State four advantages of advertising to her business.

-

This response will be reviewed and graded after submission.

Grading can be reviewed and adjusted.Grading can be reviewed and adjusted. -

-

Question 2 of 8

2. Question

(a) State four functions of a Cartel.

(b) Explain three advantages and three disadvantages of public enterprises.

-

This response will be reviewed and graded after submission.

Grading can be reviewed and adjusted.Grading can be reviewed and adjusted. -

-

Question 3 of 8

3. Question

(a) List six credit instruments used in business transactions

(b) Mr. Sylva is considering hire purchase as a source of finance for his business operations. State four advantages and three disadvantages of this source of finance.

-

This response will be reviewed and graded after submission.

Grading can be reviewed and adjusted.Grading can be reviewed and adjusted. -

-

Question 4 of 8

4. Question

(a) Explain four factors to be considered in setting up a retail business.

(b) State how the government uses the following to regulate business.

- Registration of business name

- Patent

- Trademark

- Copyright

-

This response will be reviewed and graded after submission.

Grading can be reviewed and adjusted.Grading can be reviewed and adjusted. -

Question 5 of 8

5. Question

(a) State four functions of a Stock Exchange.

(b) Explain the following types of securities traded on the Stock Exchange:

- Debentures

- Bonds

- Shares

- Stock

-

This response will be reviewed and graded after submission.

Grading can be reviewed and adjusted.Grading can be reviewed and adjusted. -

Question 6 of 8

6. Question

(a) State five functions of an Export Promotion Council.

(b) Outline five roles performed by the Customs and Exercise Authority towards the growth of Commerce.

-

This response will be reviewed and graded after submission.

Grading can be reviewed and adjusted.Grading can be reviewed and adjusted. -

-

Question 7 of 8

7. Question

Emeka has been a sales representative for three years but has never met his target.

(a) State five reasons that could have accounted for his inability to meet his target.

(b) Explain five promotional tools he could use to stimulate sales of his company’s products.

-

This response will be reviewed and graded after submission.

Grading can be reviewed and adjusted.Grading can be reviewed and adjusted. -

-

Question 8 of 8

8. Question

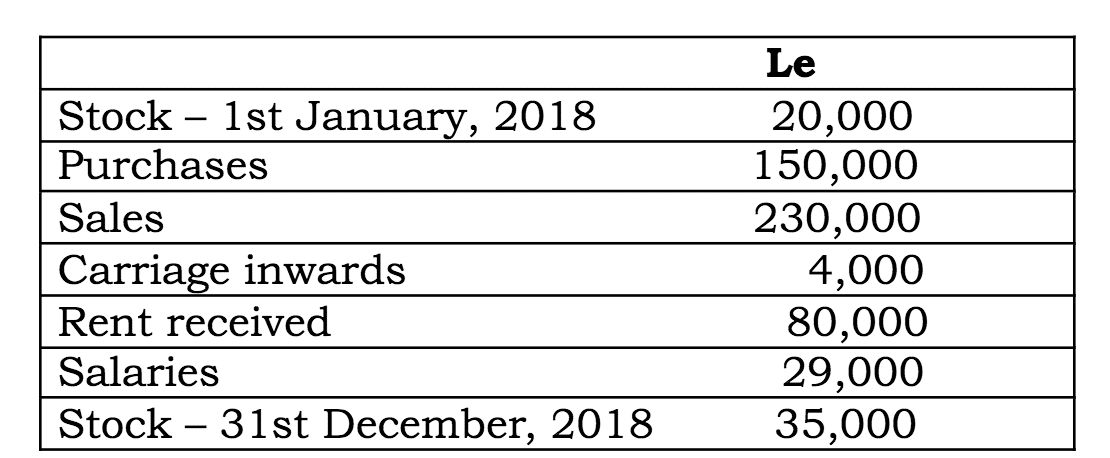

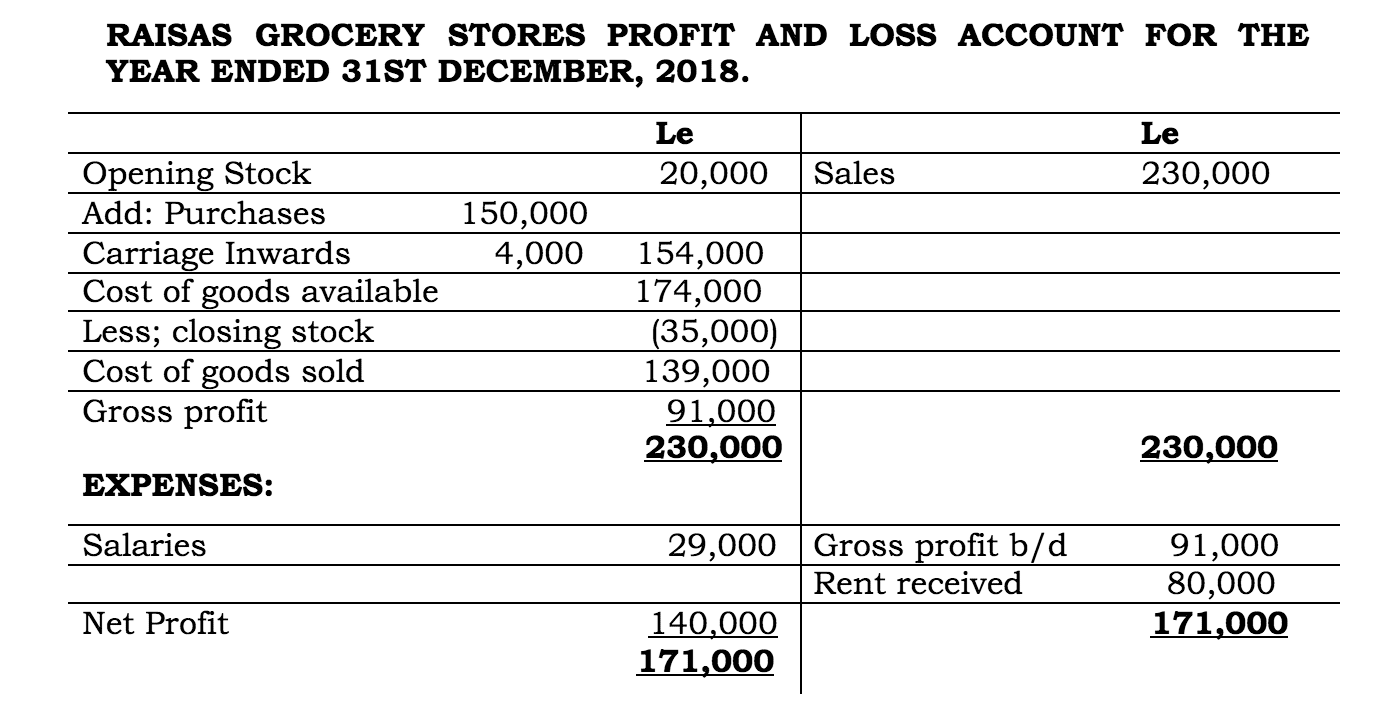

The following information relates to Raisa’s grocery store as at 31st December, 2018.

You are required to calculate:

- Gross profit

- Net profit

- Percentage of gross profit

-

This response will be reviewed and graded after submission.

Grading can be reviewed and adjusted.Grading can be reviewed and adjusted.

Responses