WAEC: ECONOMICS

Quizzes

-

2021 Economics WAEC Objective Past Questions

-

2021 Economics WAEC Theory Past Questions

-

2020 Economics WAEC Objective Past Questions

-

2020 Economics WAEC Theory Past Questions

-

2019 Economics WAEC Objective Past Questions

-

2019 Economics WAEC Theory Past Questions

-

2018 Economics WAEC Objective Past Questions

-

2018 Economics WAEC Theory Past Questions

-

2017 Economics WAEC Objective Past Questions

-

2017 Economics WAEC Theory Past Questions

-

2016 Economics WAEC Objective Past Questions

-

2016 Economics WAEC Theory Past Questions

-

2015 Economics WAEC Objective Past Questions

-

2015 Economics WAEC Theory Past Questions

-

2014 Economics WAEC Objective Past Questions

-

2014 Economics WAEC Theory Past Questions

Quiz Summary

0 of 8 Questions completed

Questions:

Information

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading…

You must sign in or sign up to start the quiz.

You must first complete the following:

Results

Results

0 of 8 Questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 point(s), (0)

Earned Point(s): 0 of 0, (0)

0 Essay(s) Pending (Possible Point(s): 0)

Categories

- Not categorized 0%

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- Current

- Review

- Answered

- Correct

- Incorrect

-

Question 1 of 8

1. Question

The following data shows the budget of a hypothetical country in 2006.

Study data and answer the questions that follow:

Revenue ($ million) Company tax 240 Workers’ income tax 160 Excise duties 80 Taxes on exports 100 Value added tax 150 Import duties 90 Non-tax revenue 40 Expenditure ($ million) Construction of roads 100 Building of schools 120 Payment of workers’ salaries 150 Government administration 200 Maintenance of health facilities 220 Extension of electricity to rural areas 180 Maintenance of official vehicles 70 (a) How much revenues was realized from:

(i) direct taxes

(ii) indirect taxes

(b) Calculate the total:

(i) recurrent expenditure

(ii) capital expenditure

(c) What percentage of total revenue was collected as indirect tax?

(d) State two examples of non-tax revenue

(e) What was the budget surplus or deficit? Explain your answer.

-

This response will be reviewed and graded after submission.

Grading can be reviewed and adjusted.Grading can be reviewed and adjusted. -

-

Question 2 of 8

2. Question

The utility schedule of a consumer for a brand of ice cream is shown in the table below. Use the information to answer the questions that follow:

Units consumed Total utility (TU) Marginal utility (MU) 0 0 — 1 10 10 2 19 R 3 P 6 4 30 5 5 31 S 6 Q 0 7 29 -2 (a) Calculate the values of P, Q, and S.

(b) Given that the price of ice cream is $ 1.00 per unit, at what level of consumption is the consumer in equilibrium? Explain your answer.

(c) Use a graph sheet, draw the marginal utility curve.

(d) State the law of diminishing marginal utility.

-

This response will be reviewed and graded after submission.

Grading can be reviewed and adjusted.Grading can be reviewed and adjusted. -

-

Question 3 of 8

3. Question

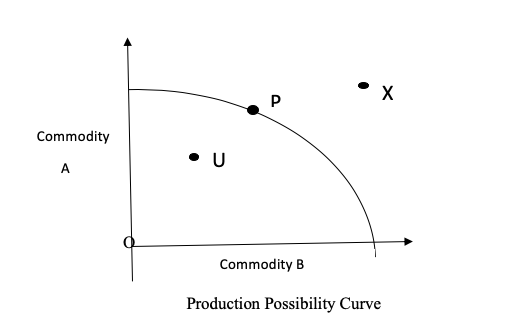

(a) What is a production possibility curve?

(b) Draw a production possibility curve and indicate any:

(i) Point P, where resources are fully utilized;

(ii) Point U, where resources are underutilized;

(iii) Point X, where production is not feasible.(c) Explain any two factors that can make production at Point X feasible.

(d) Why is the production possibility curve negatively sloped?

-

This response will be reviewed and graded after submission.

Grading can be reviewed and adjusted.Grading can be reviewed and adjusted. -

-

Question 4 of 8

4. Question

(a) What is:

(i) peasant farming?

(ii) Co-operative farming?(b) Identify any five ways through which the government can assist peasant farmers.

-

This response will be reviewed and graded after submission.

Grading can be reviewed and adjusted.Grading can be reviewed and adjusted. -

-

Question 5 of 8

5. Question

(a) What is price elasticity of supply?

(b) Differentiate between joint supply and competitive supply.

(c) Explain any four determinants of elasticity of supply.

-

This response will be reviewed and graded after submission.

Grading can be reviewed and adjusted.Grading can be reviewed and adjusted. -

-

Question 6 of 8

6. Question

(a) Define:

(i) Building Society

(ii) Central Bank.(b) Highlight any five instruments of the Central Bank in regulating the supply of money

-

This response will be reviewed and graded after submission.

Grading can be reviewed and adjusted.Grading can be reviewed and adjusted. -

-

Question 7 of 8

7. Question

(a) Who is a discriminating monopolist?

(b) Explain any four conditions necessary for a monopolist to practise price discrimination.

(c) Explain any two benefits enjoyed by a discriminating monopolist.

-

This response will be reviewed and graded after submission.

Grading can be reviewed and adjusted.Grading can be reviewed and adjusted. -

-

Question 8 of 8

8. Question

Explain the following National Income concepts:

(a) Gross Domestic Product (GDP

(b) Gross National Product (GNP

(c) Cost of living

(d) Per Capital income

(e) Standard of living

-

This response will be reviewed and graded after submission.

Grading can be reviewed and adjusted.Grading can be reviewed and adjusted. -

Responses