WAEC: ECONOMICS

Quizzes

-

2021 Economics WAEC Objective Past Questions

-

2021 Economics WAEC Theory Past Questions

-

2020 Economics WAEC Objective Past Questions

-

2020 Economics WAEC Theory Past Questions

-

2019 Economics WAEC Objective Past Questions

-

2019 Economics WAEC Theory Past Questions

-

2018 Economics WAEC Objective Past Questions

-

2018 Economics WAEC Theory Past Questions

-

2017 Economics WAEC Objective Past Questions

-

2017 Economics WAEC Theory Past Questions

-

2016 Economics WAEC Objective Past Questions

-

2016 Economics WAEC Theory Past Questions

-

2015 Economics WAEC Objective Past Questions

-

2015 Economics WAEC Theory Past Questions

-

2014 Economics WAEC Objective Past Questions

-

2014 Economics WAEC Theory Past Questions

Quiz Summary

0 of 8 Questions completed

Questions:

Information

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading…

You must sign in or sign up to start the quiz.

You must first complete the following:

Results

Results

0 of 8 Questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 point(s), (0)

Earned Point(s): 0 of 0, (0)

0 Essay(s) Pending (Possible Point(s): 0)

Categories

- Not categorized 0%

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- Current

- Review

- Answered

- Correct

- Incorrect

-

Question 1 of 8

1. Question

The table below shows the composition of exports and imports in a hypothetical country. Use the information in the table to answer the questions that follow.

Exports Amount $ Imports Amount $ Crude oil 120,000,000 Rice and flour 140,000,000 Groundnuts 40,000,000 Petroleum product 30,000,000 Tourism 45,000,000 Vehicles/accessories 50,000,000 Shipping and insurance 60,000,000 Banking services 60,000,000 Bauxite 80,000,000 Freight/insurance 40,000,000 (a) Calculate the value of visible exports.

(b) Calculate the balance of trade for the country.

(c) List the items of invisible exports and imports.

(d) Calculate the current account balance of the country.

(e) Is the country developed or developing? Give one reason for your answer.

-

This response will be reviewed and graded after submission.

Grading can be reviewed and adjusted.Grading can be reviewed and adjusted. -

-

Question 2 of 8

2. Question

The cost and output schedule of a firm are shown in the table below.

Output (kg) 6 15 35 60 85 Variable cost ($) 0 30 55 75 90 Total cost ($) 15 45 70 90 105 Total revenue ($) 0 30 70 120 170 (a) Using the data in the table, at each level of output, calculate the firm’s

(i) marginal revenue

(ii) marginal cost.

(b) At what output level did the firm:

(i) break even

(ii) make the highest profit

(iii) attain equilibrium

(c) Identify the market structure in which the firm operates

-

This response will be reviewed and graded after submission.

Grading can be reviewed and adjusted.Grading can be reviewed and adjusted. -

-

Question 3 of 8

3. Question

(a) Define optimum population.

(b) In what three ways can rapid population growth slow down the rate of economic development?

(c) Describe any three measures that can be adopted to control rapid population growth.

-

This response will be reviewed and graded after submission.

Grading can be reviewed and adjusted.Grading can be reviewed and adjusted. -

-

Question 4 of 8

4. Question

(a) What are state-owned enterprises?

(b) State any three reasons for the establishment of state-owned enterprises.

(c) Highlight any four problems associated with state-owned enterprises.

-

This response will be reviewed and graded after submission.

Grading can be reviewed and adjusted.Grading can be reviewed and adjusted. -

-

Question 5 of 8

5. Question

(a) Differentiate between unemployment and underemployment.

(b) With one example each, explain the following

(i) Seasonal unemployment

(ii) Structural unemployment

(iii) Frictional unemployment

(iv) Cyclical unemployment-

This response will be reviewed and graded after submission.

Grading can be reviewed and adjusted.Grading can be reviewed and adjusted. -

-

Question 6 of 8

6. Question

(a) What is commodity money?

(b) Identify any three problems associated with trade by barter.

(c) Explain any three ways by which the advent of money has solved the problems of the barter system.

-

This response will be reviewed and graded after submission.

Grading can be reviewed and adjusted.Grading can be reviewed and adjusted. -

-

Question 7 of 8

7. Question

(a) What is a demand schedule?

(b) State the law of demand.

(c) Using appropriate examples, explain the following types of demand:

(i) Competitive demand

(ii) Derived demand

(iii) Joint demand

(iv) Composite demand-

This response will be reviewed and graded after submission.

Grading can be reviewed and adjusted.Grading can be reviewed and adjusted. -

-

Question 8 of 8

8. Question

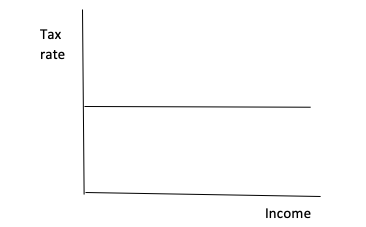

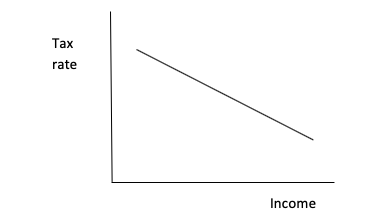

(a) What is a tax?

(b) Describe the following rates of taxation.

(i) Progressive tax

(ii) Proportional tax

(iii) Regressive tax(c) Explain the following principles of a good tax system:

(i) Equity

(ii) Convenience

(iii) Economy-

This response will be reviewed and graded after submission.

Grading can be reviewed and adjusted.Grading can be reviewed and adjusted. -

Nice