WAEC: FINANCIAL ACCOUNTING

Quizzes

-

2014 Financial Accounting WAEC Objective Past Questions

-

2014 Financial Accounting WAEC Theory Past Questions

-

2015 Financial Accounting WAEC Objective Past Questions

-

2015 Financial Accounting WAEC Theory Past Questions

-

2016 Financial Accounting WAEC Objective Past Questions

-

2016 Financial Accounting WAEC Theory Past Questions

-

2017 Financial Accounting WAEC Theory Past Questions

-

2017 Financial Accounting WAEC Objective Past Questions

-

2018 Financial Accounting WAEC Objective Past Questions

-

2018 Financial Accounting WAEC Theory Past Questions

-

2019 Financial Accounting WAEC Objective Past Questions

-

2019 Financial Accounting WAEC Theory Past Questions

-

2020 Financial Accounting WAEC Objective Past Questions

-

2020 Financial Accounting WAEC Theory Past Questions

-

2021 Financial Accounting WAEC Objective Past Questions

-

2021 Financial Accounting WAEC Theory Past Questions

Quiz Summary

0 of 9 Questions completed

Questions:

Information

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading…

You must sign in or sign up to start the quiz.

You must first complete the following:

Results

Results

0 of 9 Questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 point(s), (0)

Earned Point(s): 0 of 0, (0)

0 Essay(s) Pending (Possible Point(s): 0)

Categories

- Not categorized 0%

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- Current

- Review

- Answered

- Correct

- Incorrect

-

Question 1 of 9

1. Question

a. Describe the following:

i. Bank statement

ii. Bank reconciliation statement

b. Explain five causes of disagreement between the cash book and the bank statement balance

-

This response will be reviewed and graded after submission.

Grading can be reviewed and adjusted.Grading can be reviewed and adjusted. -

-

Question 2 of 9

2. Question

2a. What is a suspense account?

b. Explain five errors that would not affect the agreement of the trial balance.

c. Mention a class of account that would always show (i) debit balance (ii) credit balance.

-

This response will be reviewed and graded after submission.

Grading can be reviewed and adjusted.Grading can be reviewed and adjusted. -

-

Question 3 of 9

3. Question

a. State two ratios which fall under the following classification of accounting ratios:

(i) profitability

(ii) activity ratio

(iii) liquidity

(iv) investment

(v) leverage

b. Outline:

(i) Three uses of accounting ratios,

(ii) Two limitations in the use of accounting ratios.

-

This response will be reviewed and graded after submission.

Grading can be reviewed and adjusted.Grading can be reviewed and adjusted. -

-

Question 4 of 9

4. Question

a. What is a manufacturing account?

b. Explain the following terms:

(i) prime cost (ii) factory overheads

(iii) work-in-progress

(iv) cost of goods transferred

(v) finished goods

(vi) profit on manufacturing

-

This response will be reviewed and graded after submission.

Grading can be reviewed and adjusted.Grading can be reviewed and adjusted. -

-

Question 5 of 9

5. Question

The following balances have been extracted from the books of Johnson

You are required to prepare

(a) total debtors account

(b) total creditor’s account

-

This response will be reviewed and graded after submission.

Grading can be reviewed and adjusted.Grading can be reviewed and adjusted. -

-

Question 6 of 9

6. Question

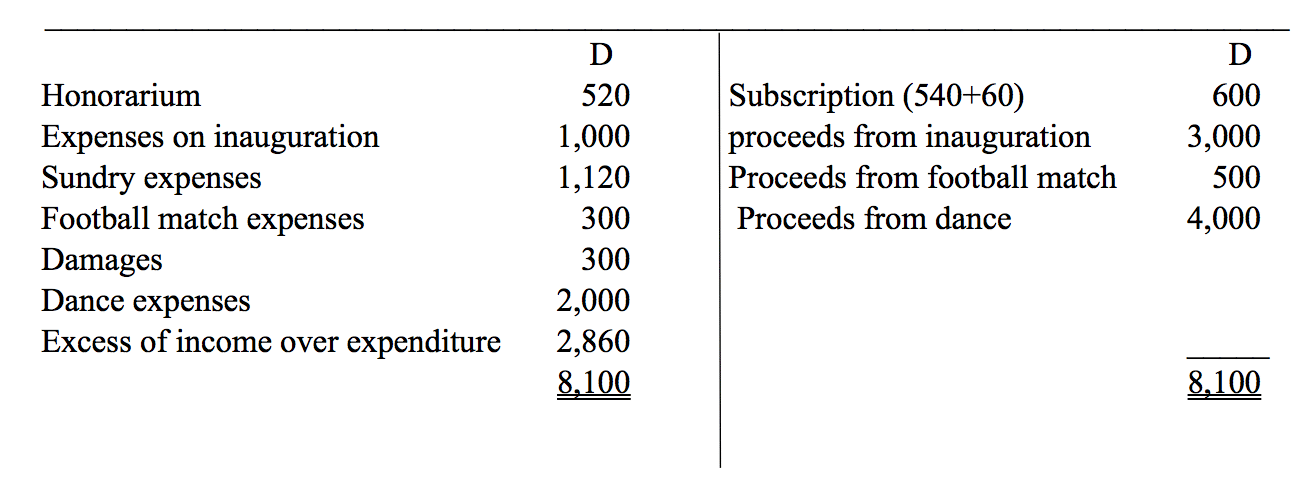

Babou social club was formed on April 1, 2013, with 50 members, each paying an annual subscription of D12.

The following information was extracted from the books of the club on 31s March 2014. March 2014.

i

Amount realized during Inauguration D3,000 Expenses paid on Inauguration D1,000 ii. All members paid their subscription with the exception of five members who were still owing by 31st March 2014

iii. Gate fees from organized football match were D500 and Expenses incurred D300

iv. Proceeds from the end of the year dance amount to 4,000 and expenses on dance D2,000

v. Honorarium to officers amounted to D500 and sundry expenses D1,120

vi. Amount paid for damages to furniture during dance D300.

You are required to prepare for the year ended 31st March 2014:

(a) Receipts and payments account

(b) income and expenditure account

-

This response will be reviewed and graded after submission.

Grading can be reviewed and adjusted.Grading can be reviewed and adjusted. -

-

Question 7 of 9

7. Question

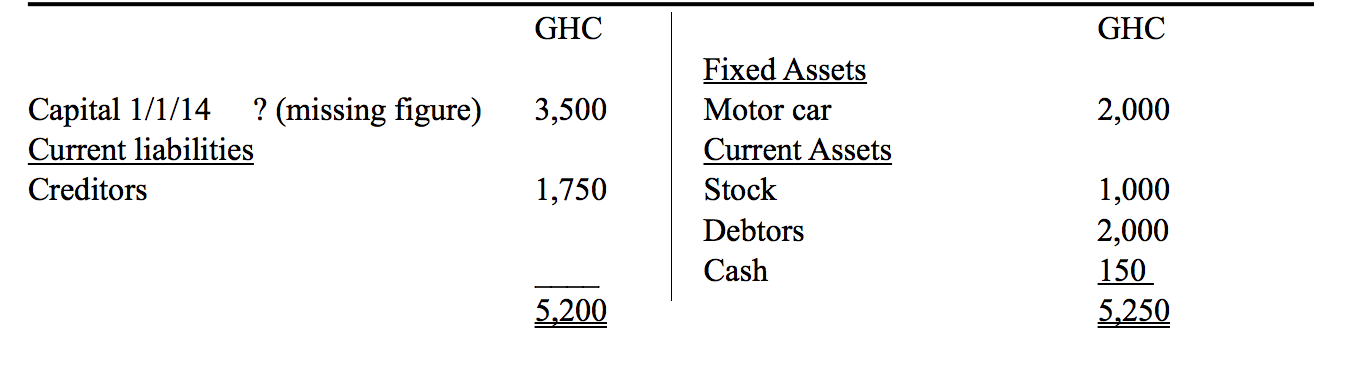

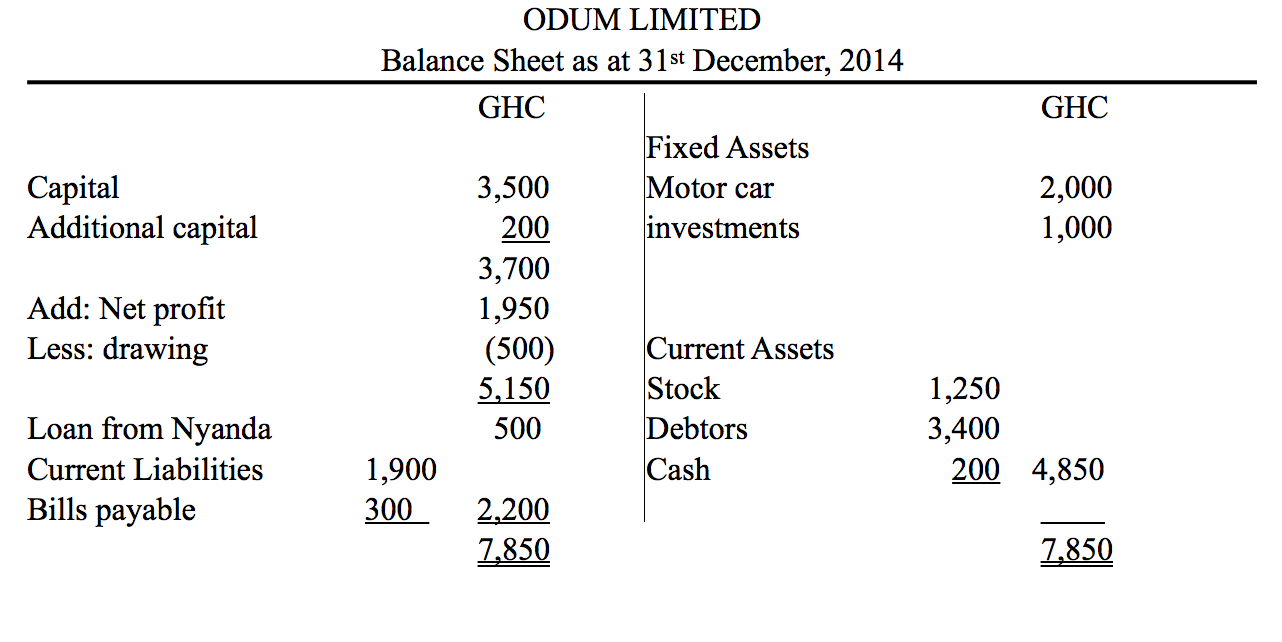

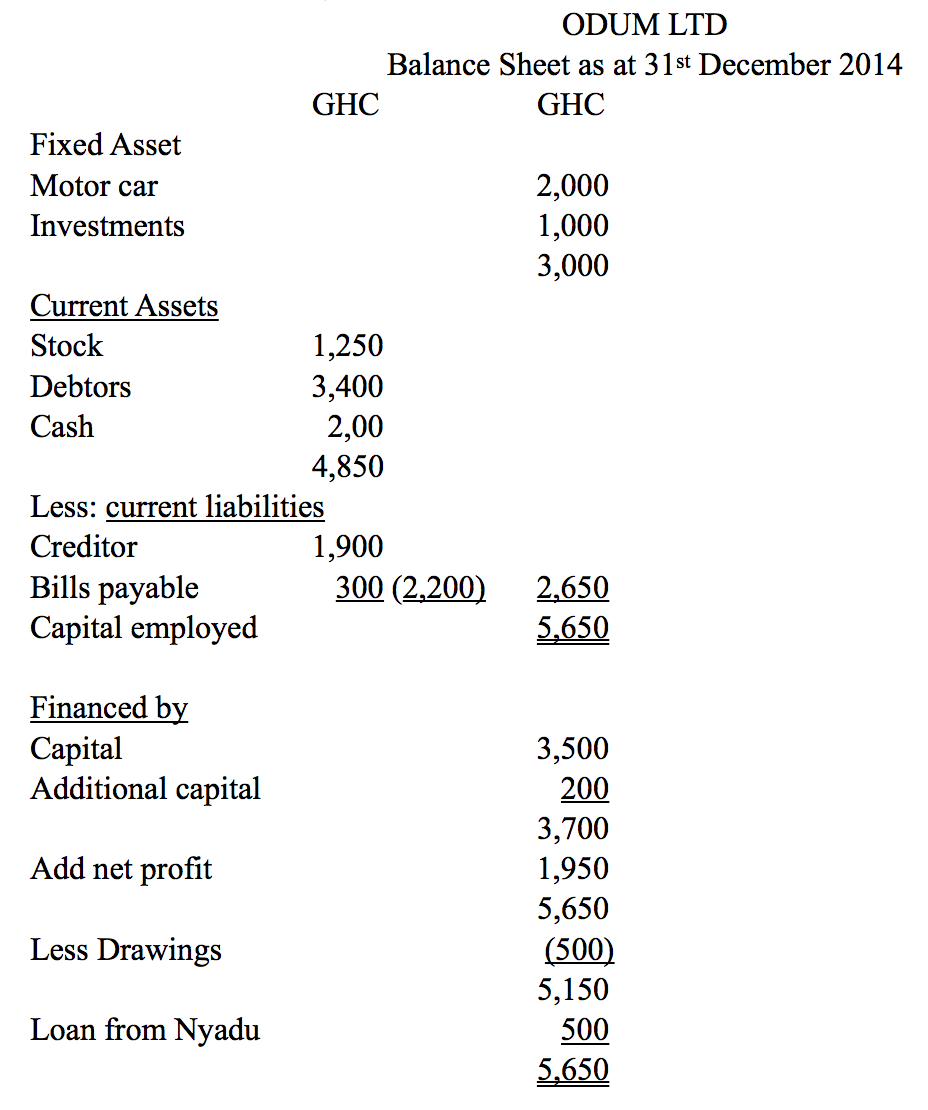

Odum Ltd keeps his books on simple entry basis and the following information relates to the business for the year 2014.

In addition, Odum withdrew an amount of GHC500 and introduced GHC200 as additional capital.

(a) You are required to ascertain

(i) opening capital

(ii) closing capital

(iii) net profit

(b) Prepare the balance sheet as at 31st December, 2014.

-

This response will be reviewed and graded after submission.

Grading can be reviewed and adjusted.Grading can be reviewed and adjusted. -

-

Question 8 of 9

8. Question

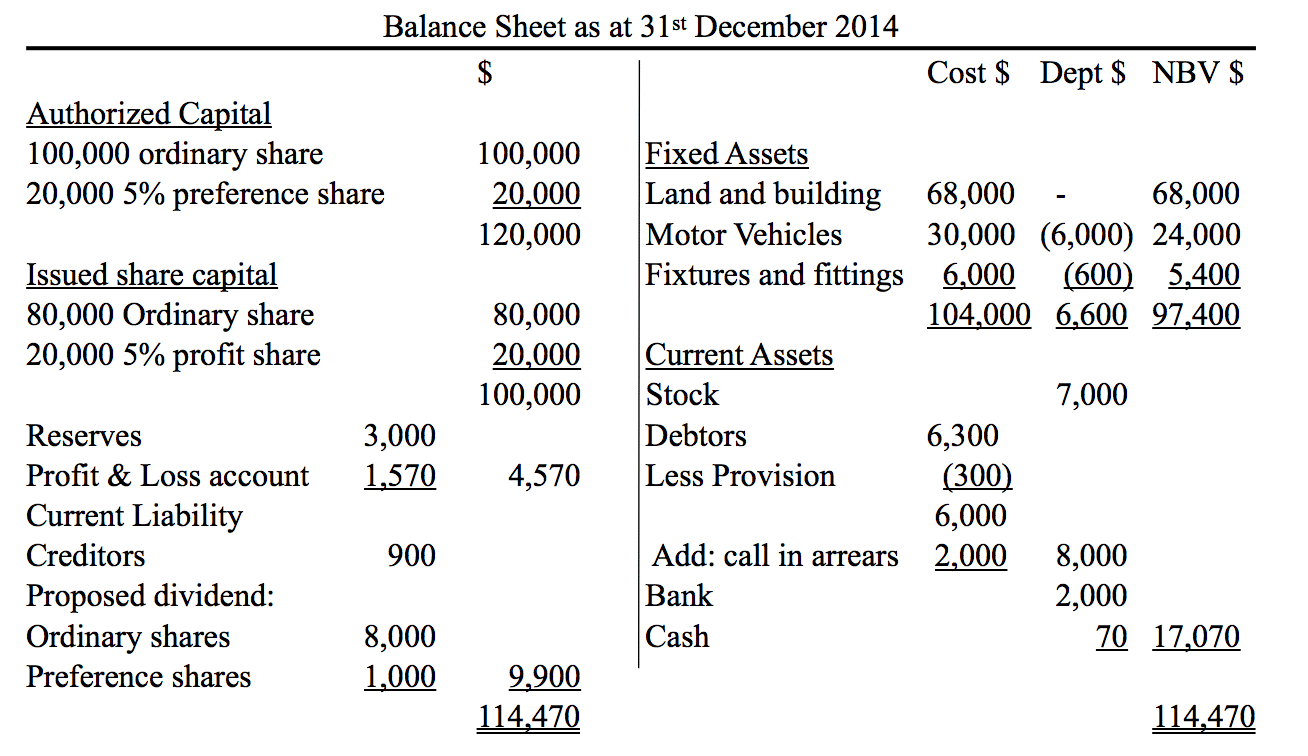

Weah CO. Ltd has an authorized capital of $20,000 divided into 100,000 ordinary shares and 20,000 5% preference share

Additional information: provide for depreciation on a motor vehicle at 20% and furniture and fittings at 10% per annum.

The directors decided to transfer $3,000 to reserve: recommend a dividend of 10% on ordinary shares and pay preference shares dividend.

You are required to prepare:

a. Appropriation account/ income surplus account for the year ended 31st December 2014

b. A balance sheet as at that date.

-

This response will be reviewed and graded after submission.

Grading can be reviewed and adjusted.Grading can be reviewed and adjusted. -

-

Question 9 of 9

9. Question

The following balances were extracted from the books of Bonjuri, a retailer as at 31st March 2014.

Additional information:

i. Stock on 31st March 2014 was valued at Le60,000

ii. At 31st March, 2014 Le1,500 was outstanding on insurance; electricity was prepaid by Le500 and there was a doubtful debt of Le1,000

iii. Depreciation is to be provided on equipment at 10% on cost.

You are required to prepare:

(a) Trading profit and loss account for the year ended 31st March 2014

(b) Balance sheet as at that date

-

This response will be reviewed and graded after submission.

Grading can be reviewed and adjusted.Grading can be reviewed and adjusted. -

Responses