Topic Content:

- Commercial Banks – Services/Functions

1. Accepting Deposits:

Commercial banks accept deposits from customers for safekeeping. Opportunities are provided for withdrawals whenever necessary by the customers. There are three types of accounts used in recording customers’ deposits. They are:

i. Current Account:

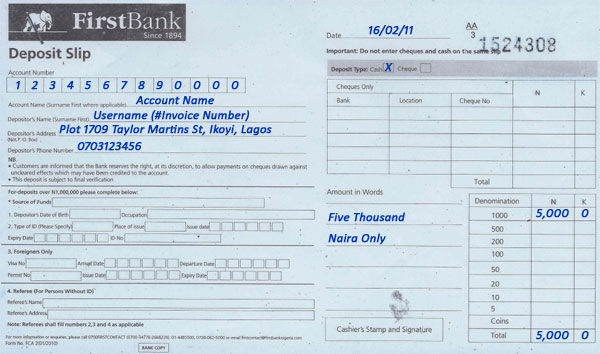

The current account is also called a demand deposit account. It is one account that is commonly used by traders and workers for their financial transactions in the bank. When this account is opened, a chequebook is given to the customers to facilitate withdrawals. The bank accepts deposits into a current account using a deposit slip, which states the amount to be deposited.

ii. Fixed Deposit Account:

A fixed deposit account is opened by a customer having excess liquid. Money not immediately needed is paid into this account for a fixed or specified period. An assured interest rate is paid for keeping the funds for a particular period. Fixed Deposits are an easy way to earn returns from funds that are lying idle.

You are viewing an excerpt of this Topic. Subscribe Now to get Full Access to ALL this Subject's Topics and Quizzes for this Term!

Click on the button "Subscribe Now" below for Full Access!

Subscribe Now

Note: If you have Already Subscribed and you are seeing this message, it means you are logged out. Please Log In using the Login Button Below to Carry on Studying!

Responses