Topic Content:

- How to Record Cash Received or Payment in the Ledger

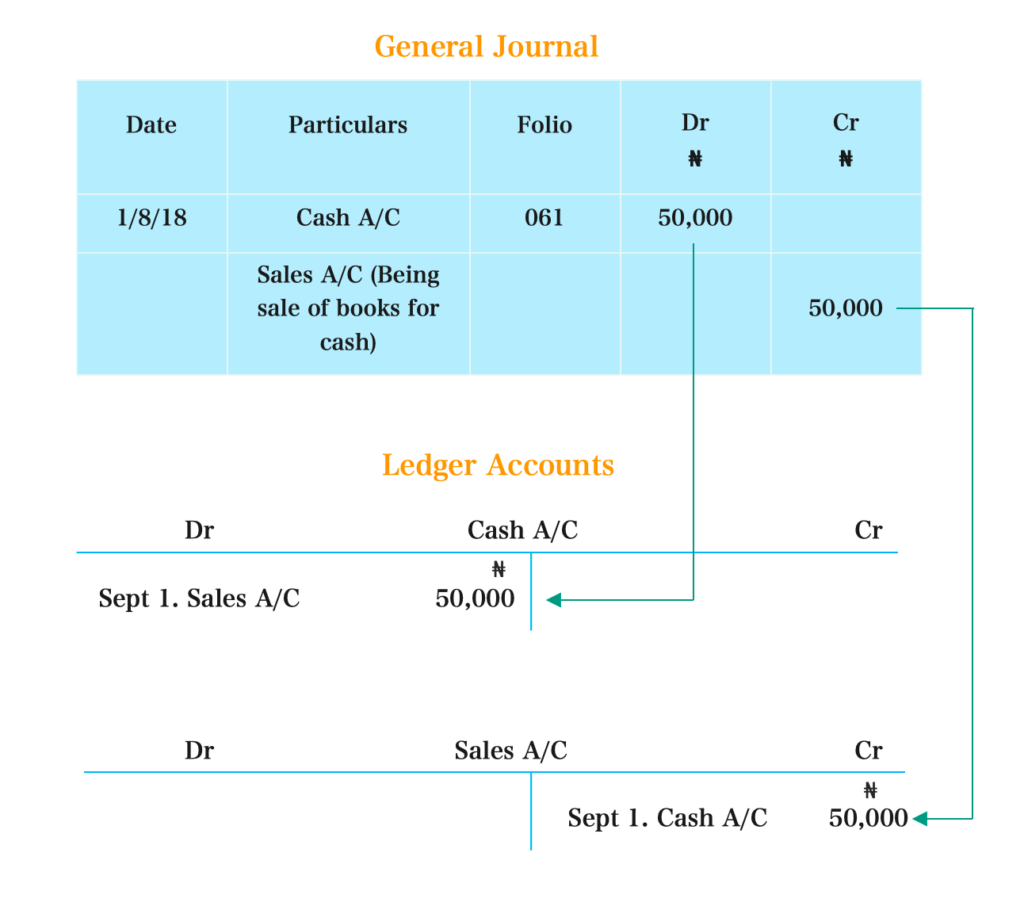

Posting is the process of transferring the entries from the books of original/prime entry (journal) to the ledger.

No new information is needed to prepare ledger accounts. The information that has already been recorded in the journal is just transferred to the relevant ledger accounts.

Let’s illustrate the format of a ledger account by preparing a journal entry and then transferring it to the relevant ledger accounts.

Transaction: on September 1, 2018, Kofa Enterprise sold books to customers for cash ₦50,000.

First, Let’s post this transaction to the general journal and then to the relevant ledger accounts.

The debit part of the above journal entry is “cash account” and the credit part is “sales account”. So the amount of the journal entry (₦50,000) is written on the debit side of the cash account and credit side of the sales account.

Ordinarily, cash paid out is usually recorded in a special book of accounts called a cash book. The examples below show how cash received and paid out are recorded in the ledger.

Example 9.2.1:

2nd August 2016, Cash sales ₦5,000

Solution:

You are viewing an excerpt of this Topic. Subscribe Now to get Full Access to ALL this Subject's Topics and Quizzes for this Term!

Click on the button "Subscribe Now" below for Full Access!

Subscribe Now

Note: If you have Already Subscribed and you are seeing this message, it means you are logged out. Please Log In using the Login Button Below to Carry on Studying!

Thanks kofastudy for making it easier for me

thanks a lot