The opening statement of affairs will be prepared to show the opening capital. The information required are all fixed assets, a total of debtors and creditors expenses owing and payments in advance, cash in hand, etc.

(ii) Adjust the capital by adding any additional capital contributed either in cash or assets and deduct drawings either cash or goods.

(iii) Another statement of affairs will be constructed to show the closing capital using all the Assets and Liabilities at the end of the period.

(iv) The opening capital will be compared with the closing capital.

(v) If the capital at close is greater, then there is a profit.

(vi) If the Capital at close is lower, then there is a loss.

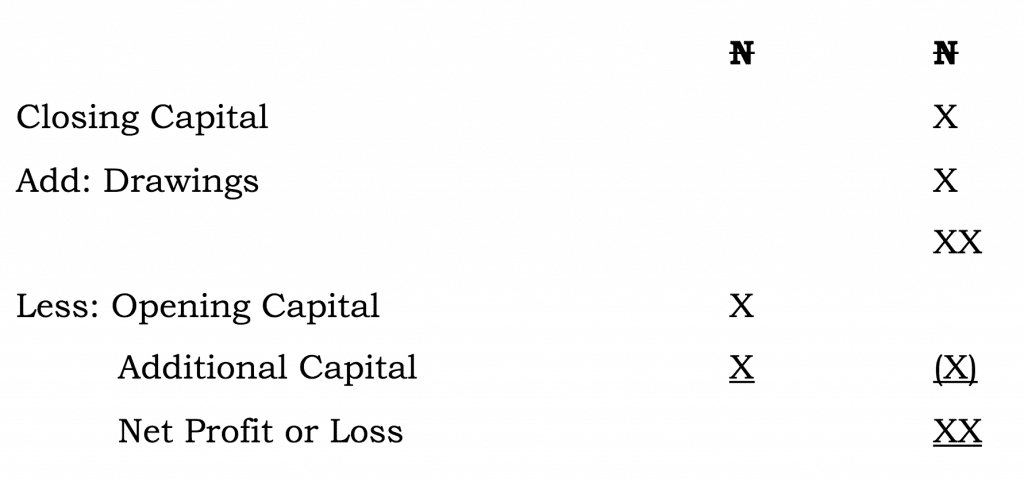

Format

Statement of Profit or Loss

Statement of profit as at 31st December, 2,000

NB: The profit can also be calculated using this formula:

Opening Capital + Profit – drawings + Additional Capital = New Capital.

Profit = New Capital + Drawing – Opening Capital – Additional Capital.

Responses