Illustration 1:

Obelawo Ltd Operates a retail branch at Aba. All purchases are made by the head office in Onitsha and goods are charged to the branch at cost plus 50%. All cash received by the branch is remitted to the head office. On 1st January 2000 stock at the start (Invoiced Price) amounted to N11,925 and debtors to N1,746.

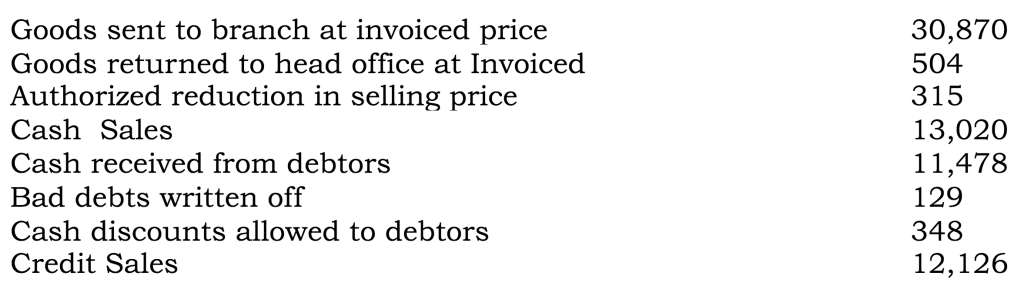

During the year ended 31st December 2000, the following transactions took place at the branch:

Goods Invoiced to the branch at N462 on 20th December was not received by the branch until January 5th 2000 and had not been included in the figures. On 31st December, stock at close at invoiced price was N16,080.

Required:

Prepare the necessary ledger accounts using the cost method.

Workings:

Since all the items are slated at Invoiced prices then it is necessary to convert the items to cost price.

1. Goods sent to branch: Selling Price: N30,870

Markup must be converted to Margin

= \( \frac{50}{100} \\ = \frac{1}{2} \\ = \frac{1}{2 \; + \: 1} \\ = \frac{1}{3} \)

Profit = \( \frac{1}{3}\) x N30,870 = N10,290

Cost Price = \( \frac{2}{3}\) x N30,870 = N20,580

2. Goods returned to head office:

Cost Price = \( \frac{2}{3}\) x 504 = N336

3. Opening Stock:

Cost Price = \( \frac{2}{3}\) x 11,925 = N7,950

4. Closing stock:

Cost Price = \( \frac{2}{3}\) x 16,080 = N10,720

5. Goods in transit:

Cost price = \( \frac{2}{3}\) x 462 = N308

Responses