Topic Content:

- Basic Cost Concepts

- Total Fixed Cost (TFC)

- Total Variable Cost (TVC)

- Total Cost (TC)

- Relationship Between TC, TFC and TVC

- Average Variable Cost (AVC)

- Average Fixed Cost (AFC)

- Average Cost (AC) or Average Total Cost (ATC)

- Relationship Between AC and AVC

- Marginal Cost (MC)

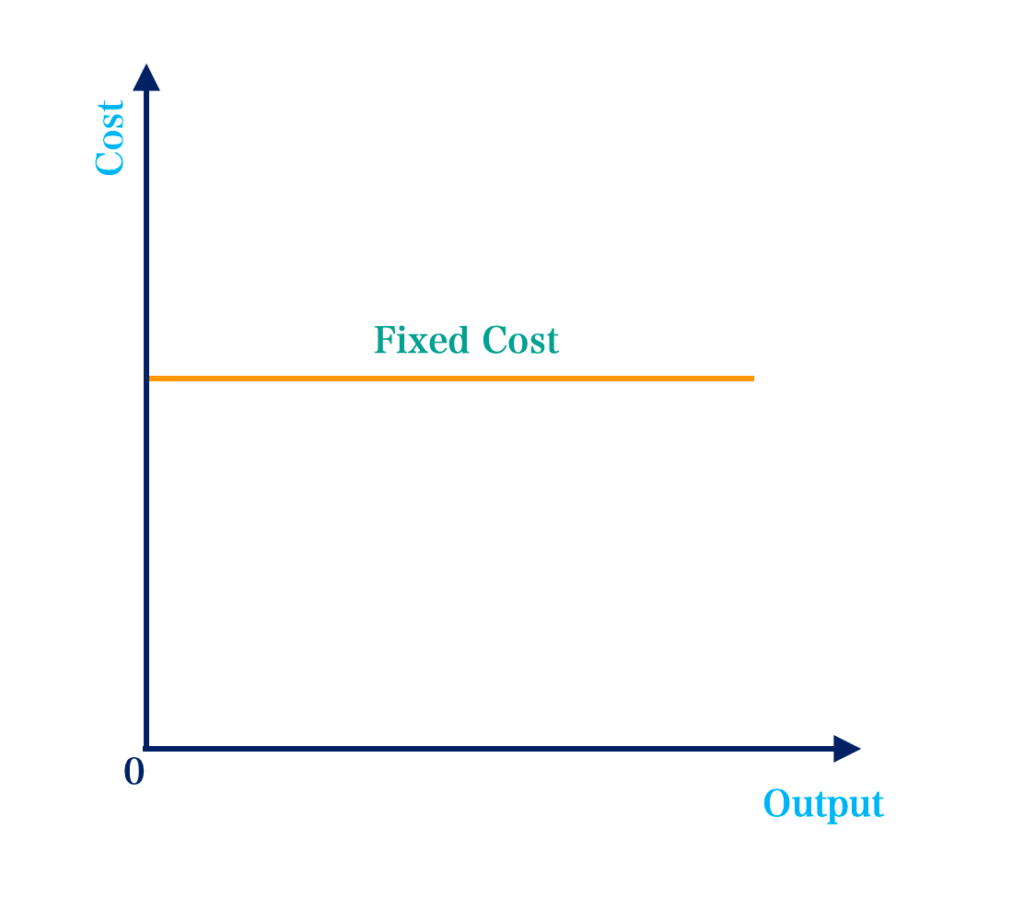

Total Fixed Cost (TFC):

These are costs incurred by the firm which do not vary with the firm’s level of production. Fixed cost is the cost incurred in acquiring capital goods, it remains constant as output varies even if the output is zero. Fixed Cost is also called supplementary cost. They are sometimes called overhead costs.

Examples are rents paid on buildings, machines, vehicles used by the firm, cost of fixed capital, depreciation charges, etc. Salaries are paid on an annual basis, so they are considered fixed, Insurance premiums are also considered as fixed costs.

It is a cost that is fixed or remains constant at any label of output whether zero output or infinite level of output.

It is calculated as:

TFC = TC – TVC

or

TFC = AFC × Quantity produced.

Total Variable Cost (TVC):

These are costs that vary with the level of production (output).

You are viewing an excerpt of this Topic. Subscribe Now to get Full Access to ALL this Subject's Topics and Quizzes for this Term!

Click on the button "Subscribe Now" below for Full Access!

Subscribe Now

Note: If you have Already Subscribed and you are seeing this message, it means you are logged out. Please Log In using the Login Button Below to Carry on Studying!

Responses