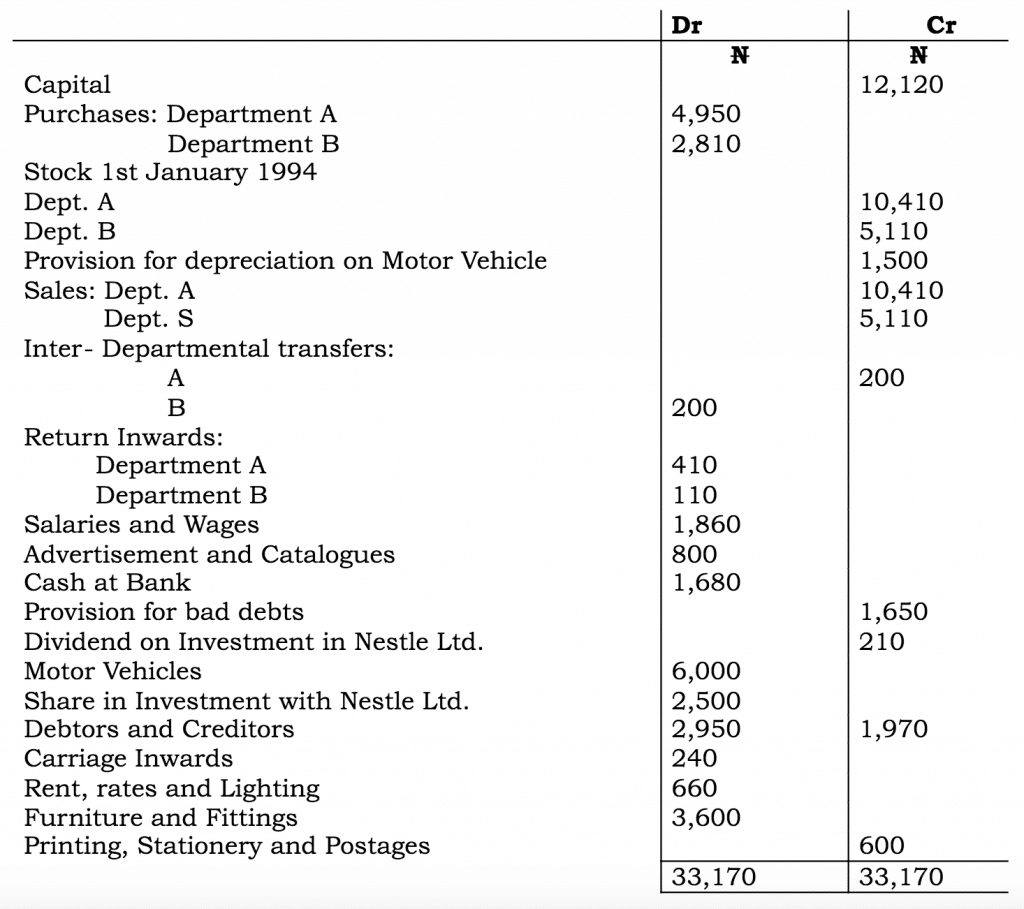

Illustration 3

The following Trial balance for the year ended 31st December 1994 was extracted from the book of Mac David Enterprises.

Additional Information

1. Debts amounting to N200 have proved unrecoverable and the provision for doubtful debt is to be reduced to 10% of the outstanding book debts.

(ii). Provide N60 for stationery, being an amount owing as at 31st December,1994.

(iii). Provide for depreciation of furniture and fitting at 10% per annum on cost and 25% on motor vehicles on cost.

(iv) Catalogues in hand as at 31st December, 1994 were valued at N380.

(v) Stock in hand as at 31st December, 1994

Department A 3,130

Department B 1,870

(vi) Inter departmental transfers were made at cost price.

(vii) All expenses except between the two department in proportion of Net Sales.

You are required to prepare:

(a) Trading profit and loss account in Columnar form for the year ended 31st December.

(b) Balance sheet as at that date.

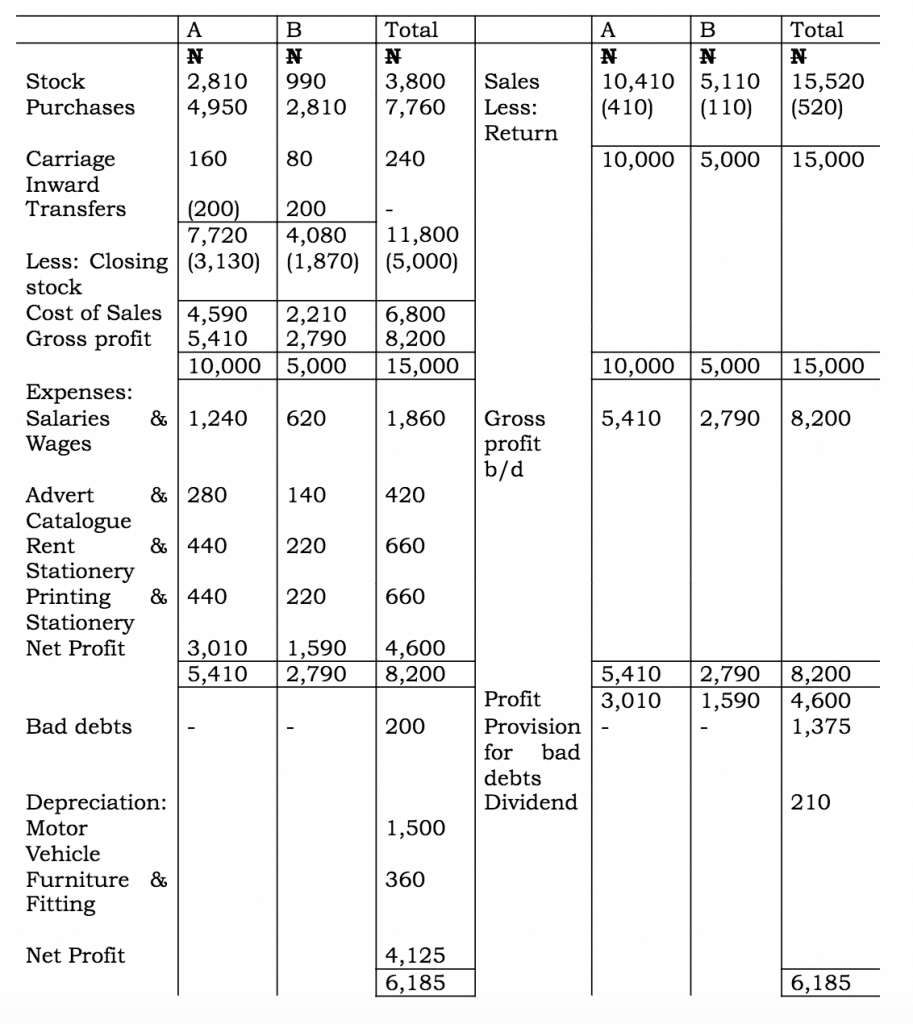

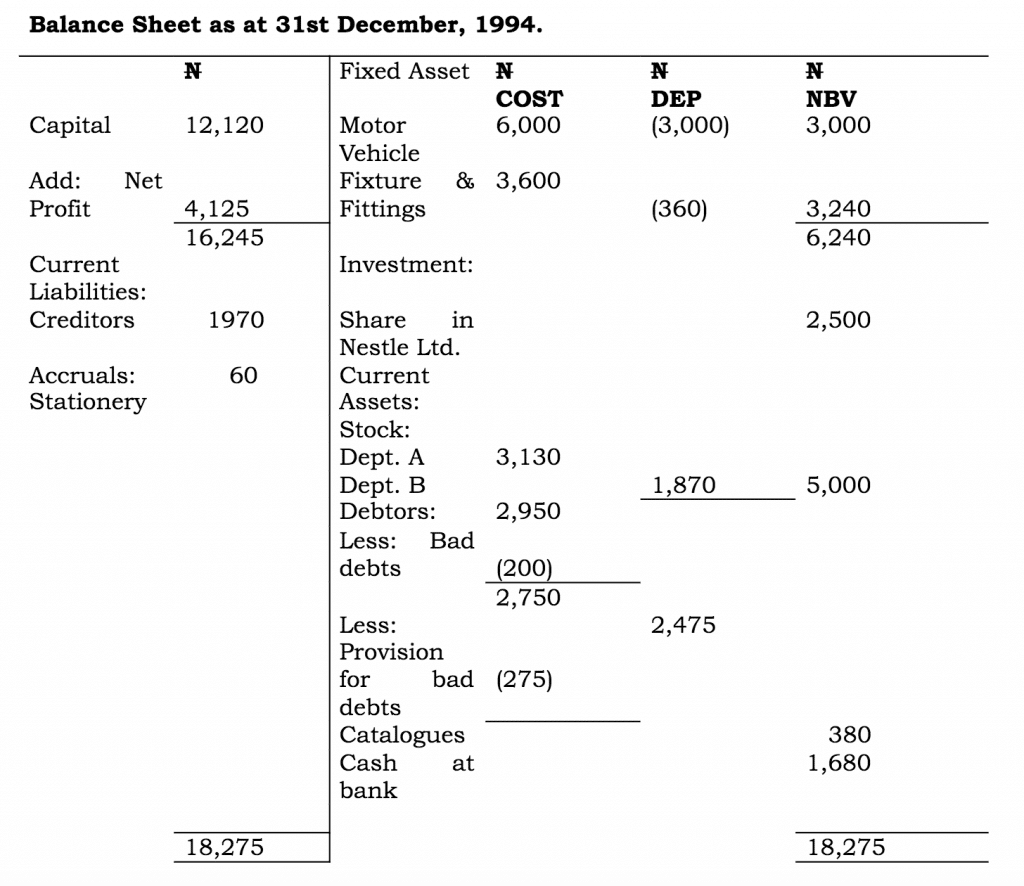

Mac David Enterprise

Departmental, Trading Profit and Loss Account for the year ended 31st December, 1994.

Note: Bad debts and depreciation are not shared between the departments because it is specified in the question.

Workings:

Proportion of Net Sales

1. Salaries and Wages:

Dept. A 10,000/15,000 x 1,860/1 = N1,240

Dept. B 5,000/15,000 x 1860/1 = N620

2. Rent, Rates and Lighting:

Dept. A 10,000/15,000 x 660/1 = N220

3. Printing and stationery

600 + 60 = N660

Dept. A 10,000/15,000 x 660 = N440

Dept. B 5,000/15,000 x 660 = N220

4. Carriage Inwards:

Dept. A 10,000/15,000 x 240 = N160

Dept. B 5,000/15,000 x 240 = N80

5. Advertisement & Catalogue

(800 – 380) = N420

Dept. A 10,000/15,000 x 420/1 N280.

Dept. B 5,000/15,000 x 420/1 N140

6. Debtors 2,950

Less: Bad debts (200)

N2,750

Provision for bad debts = 10% x N2,750= N275.

Old Provision 1,650

Reduction in provision (New provision) (275)

Transfer to profit and loss 1,375

7. Depreciation of Fixed Asset:

(i) Furniture and Fittings: 3,600 x 10% = N360

(ii) Motor Vehicle 6,000 x 25% = N150.

Responses