Illustration 1

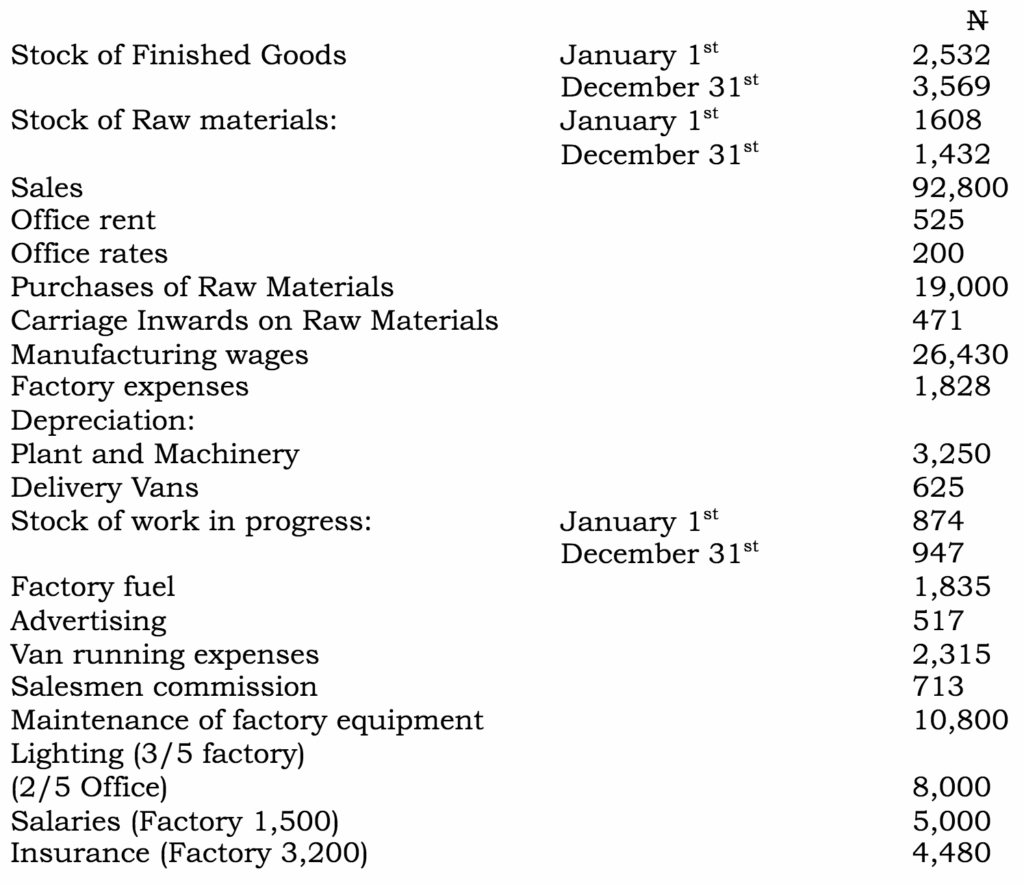

The following shows the figures extracted from the books of Ojolo, a manufacturer for the year ended 31st December, 1999.

You are required to prepare the Manufacturing Trading profit and loss account for the year ended 31st December, 1999.

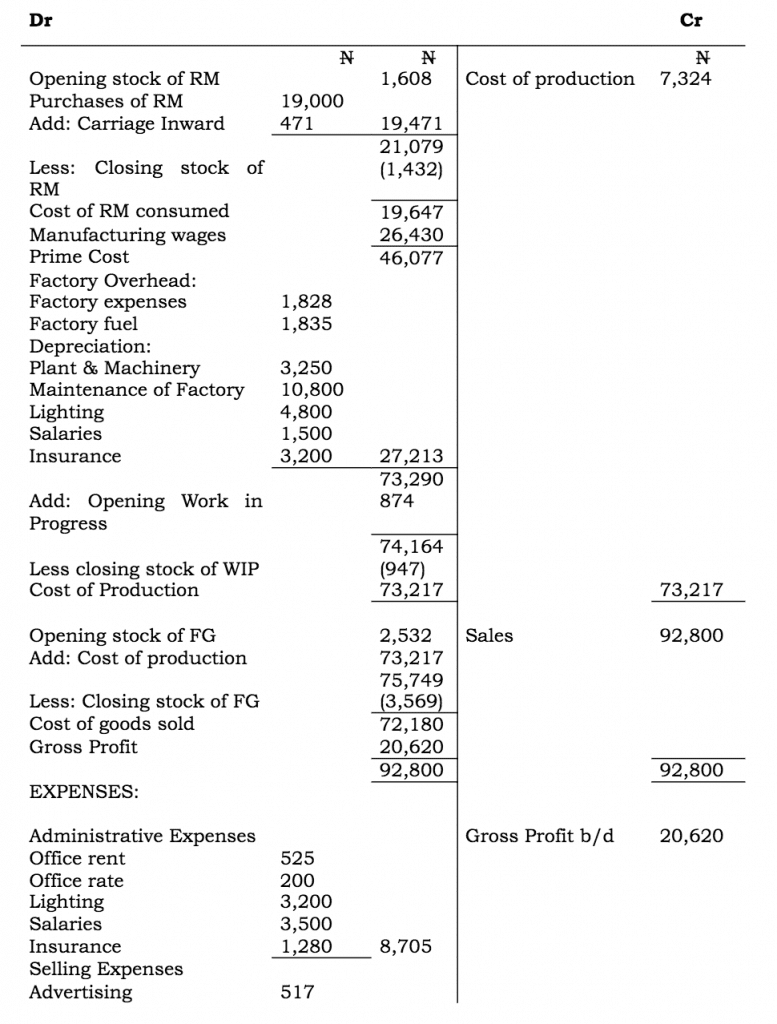

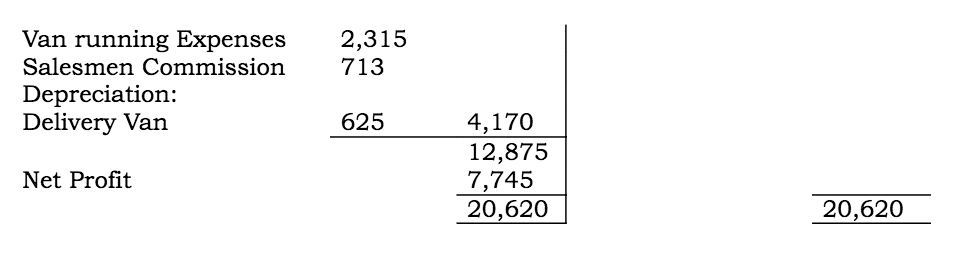

Manufacturing, Trading, Profit, and Loss Account for the year ended 31st December, 1999.

Workings

Apportionment of Expenses

1. Lighting:

\( \scriptsize Factory \; = \; \normalsize \frac {3}{5} \; \times \; \scriptsize 8000 \\ = \scriptsize N4,800 \\ \scriptsize Office \; = \; \normalsize \frac {2}{5} \; \times \; \scriptsize 8000 \\ = \scriptsize N3,200 \)2. Salaries:

\( \scriptsize Factory \; = \; N1,500 \\ \scriptsize Office \; = \; N5,000 \; – \; N1,500 \\ \scriptsize = N3,500 \)3. Insurance:

\( \scriptsize Factory \; = \; N3,200 \\ \scriptsize Office \; = \; N4,480 \; – \; N3,200 \\ \scriptsize = N1,280 \)Transfer Pricing

The goods manufactured may be charged to the trading account at the actual factory cost or at the insurance: Factory = N3,200

Office = 4,480 – 3,200 = N1,280. The current market value in order to obtain a separate profit on the Manufacturing process. The Manufacturing account will show a balance which will represent a profit or loss on production and will be transferred to the profit and loss account. This is credited to the manufacturing account and debited to the trading account. The net profit will not be affected.

Responses