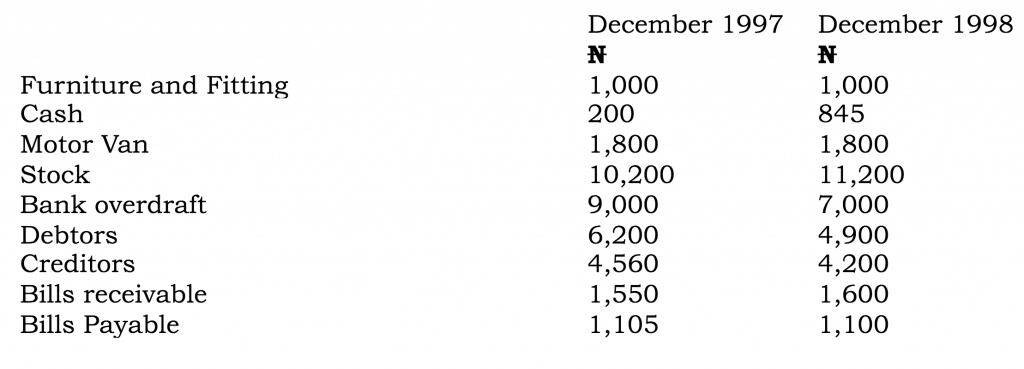

Illustration 1:

Mr. Okoro did not keep his account on a double entry basis. As a Book- Keeper, you are required to prepare the statement of profit from the following information:

During the year, he estimated the total drawing in cash as N2,580, and part of the stock costing N120 was used for domestic purposes. The following information was agreed upon:

(i) To write off bad debts N300

(ii) To allow 15% depreciation of furniture and fitting and 20% on Motor Van.

You are required to ascertain the profit or loss for the year ended 31st December, 1998, and balance sheet at that date.

Solution

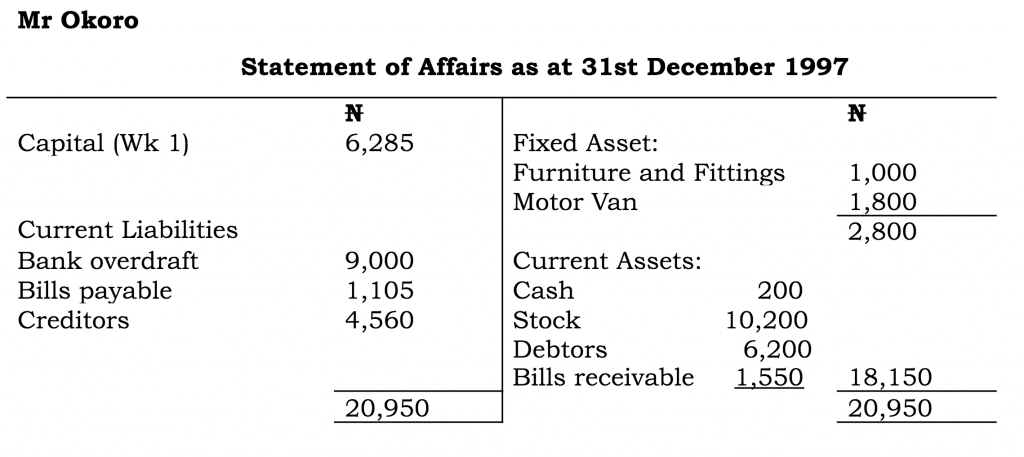

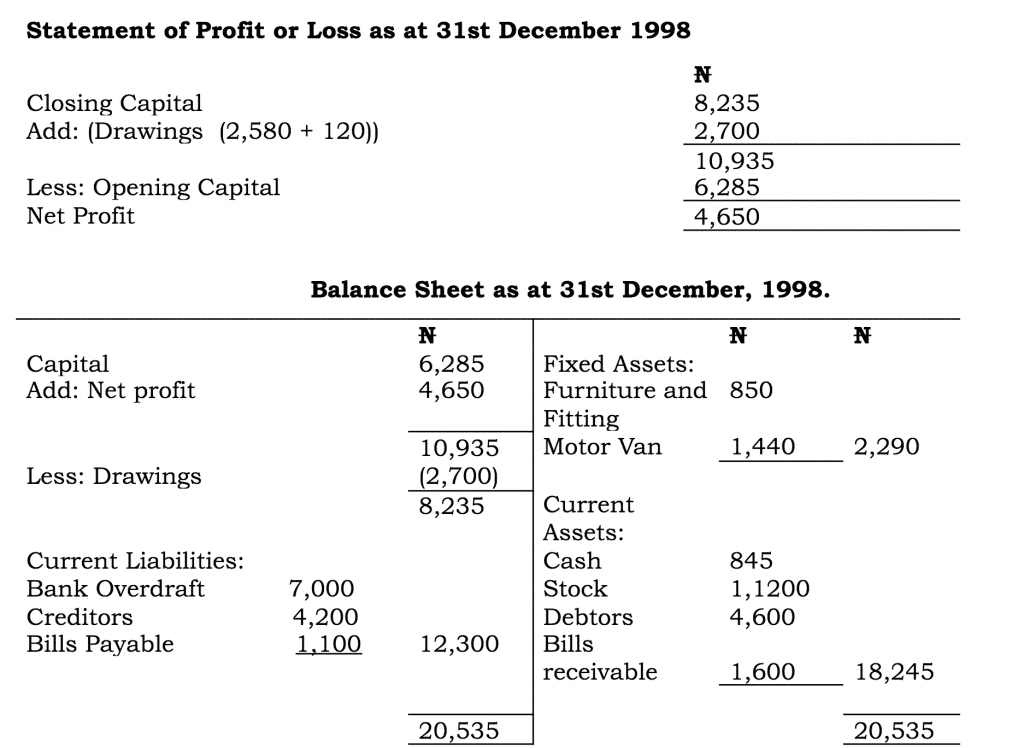

Workings:

1. Opening Capital

= Total Assets – Liabilities

20,950 – 14,665 = N6,285.

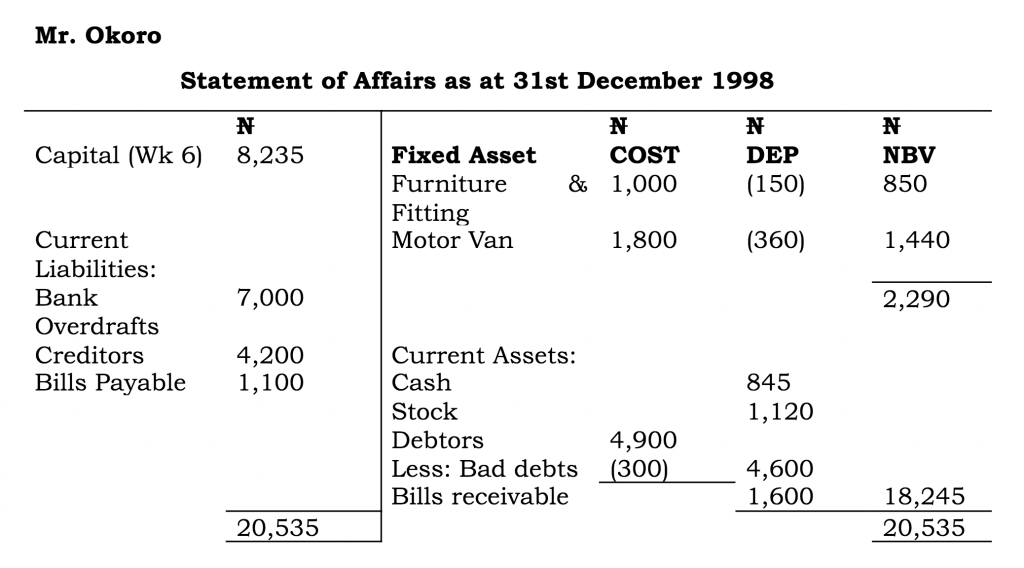

2. Furniture and Fittings:

1,000 x 15% = N150

Net book value = 1,000 – 150 = N850

3. Motor Van:

1,800 x 20% = N360

Net Book Value = 1,800 – 360 = N1,440

Responses